If the monthly salary is RM. Malaysia monthly salary after tax calculator 2022.

20 x hourly rate x number of hours in excess of 8 hours.

.png)

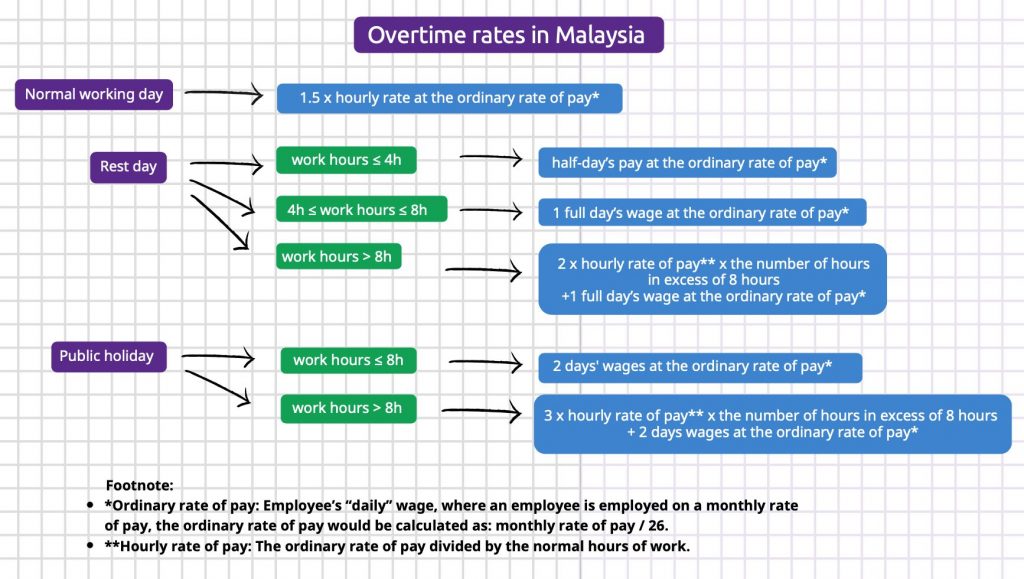

. Calculate overtime compensation by multiplying the number of hours worked over and above the usual rate of pay by one-half the regular rate of pay. 10 x ordinary rate of pay one days pay In excess of eight 8 hours-. The Employment Act provides that the minimum daily rate of pay for overtime calculations should be.

05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-. The law on overtime. If they work more than 8 hours on public holiday you need to pay them at rate 30 x for the balance overtime working hours.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. Then divide the ordinary rate by the number of normal work hours to get the hourly pay rate. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955.

Overtime entitlements under the Employment Act in Malaysia. But overtime can be a very confusing matter. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day.

First calculate the daily ordinary rate of pay by dividing the monthly salary by 26. The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. Working on Off-day 20 Basic pay 26 days X 20 X hour of works.

The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and Chinese populace. Working in excess of normal working hours on a normal work day. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox.

However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week. Overtime payHourly rate X Overtime hours X Overtime rate. Determine your usual rate of compensation by dividing your paycheck by the number of hours you worked.

Malaysias Employment Regulations 1980 has a simple definition for employee overtime pay in Malaysia. In this article we will explain a few things about overtime. Process Overtime Days or Overtime Hours.

For guide on calculating hourly rate of pay kindly refer to Calculation for Overtime Payment. Overtime Rate according to Malaysian Employment Act 1955. The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay.

Overtime pay daily rate half days. There are laws governing the hours of overtime work for employees in Malaysia. Hourly rate of pay means the daily rate of pay divided by the normal hours of work as agreed between the employers and empoyees.

Employee who works overtime on rest day not exceeding half hisher normal hours of work. The daily wage calculator is updated with the latest income tax rates in malaysia for 2022 and is a great calculator for working out your. For employees whose salary exceed RM2000 a month the hours of work and overtime work depend on the terms agreed under their employment contracts.

As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. For staff members whose monthly salary is and any increase of salary where the OT is capped at the Company pays the following overtime rate which is in accordance to the rate provided by the Malaysian Employment Act 1955 as follows-a. The law on overtime.

Employee work 10 hours on rest day. Calculate total compensation by adding overtime hours to the base salary. Working on Public Holiday.

For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. 15x hourly rate of pay.

If the employees salary does not exceed RM2000 a month or falls. Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include. Normal working day 15 Basic pay 26 days X 15 X hour of works.

Basic pay 26 days X 30 X hour of works. Finally calculate overtime pay by multiplying the hourly rate by 15 and then multiply this figure by the overtime hours. While overtime can be inevitable and has its limits it is an aspect of the job that can affect work-life balance motivation and performance.

Any overtime within an hour is not eligible for overtime payment. Monthly rate of pay26 days Section 60I 1A EA. Whereas there are also companies with a written requirement for overtime threshold eg.

In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955. In the system the daily rate of pay is divided by 8.

According to Section 60A3b overtime is defined as the number of hours of work. Overtime on Normal Working Day. Here is the formula and an example.

11 minutes Editors note. 658 X 2 X 3. In Malaysia overtime is still popular among companies especially in the FB sector.

For holiday you should pay employee at rate 20 X for the first 8 working hours. You may receive a monthly or daily salary.

1 Unit 5 Payment Systems And Working Hours 2 Introduction Payment And Working Hours Play A Major Role In Attracting Employees And Retaining Good Performers Ppt Download

Salary Calculator Difference Between Gross Salary And Net Salary

Helicopter Pilot Average Salary In Malaysia 2022 The Complete Guide

Overtime Calculation In Malaysia Cannonctzx

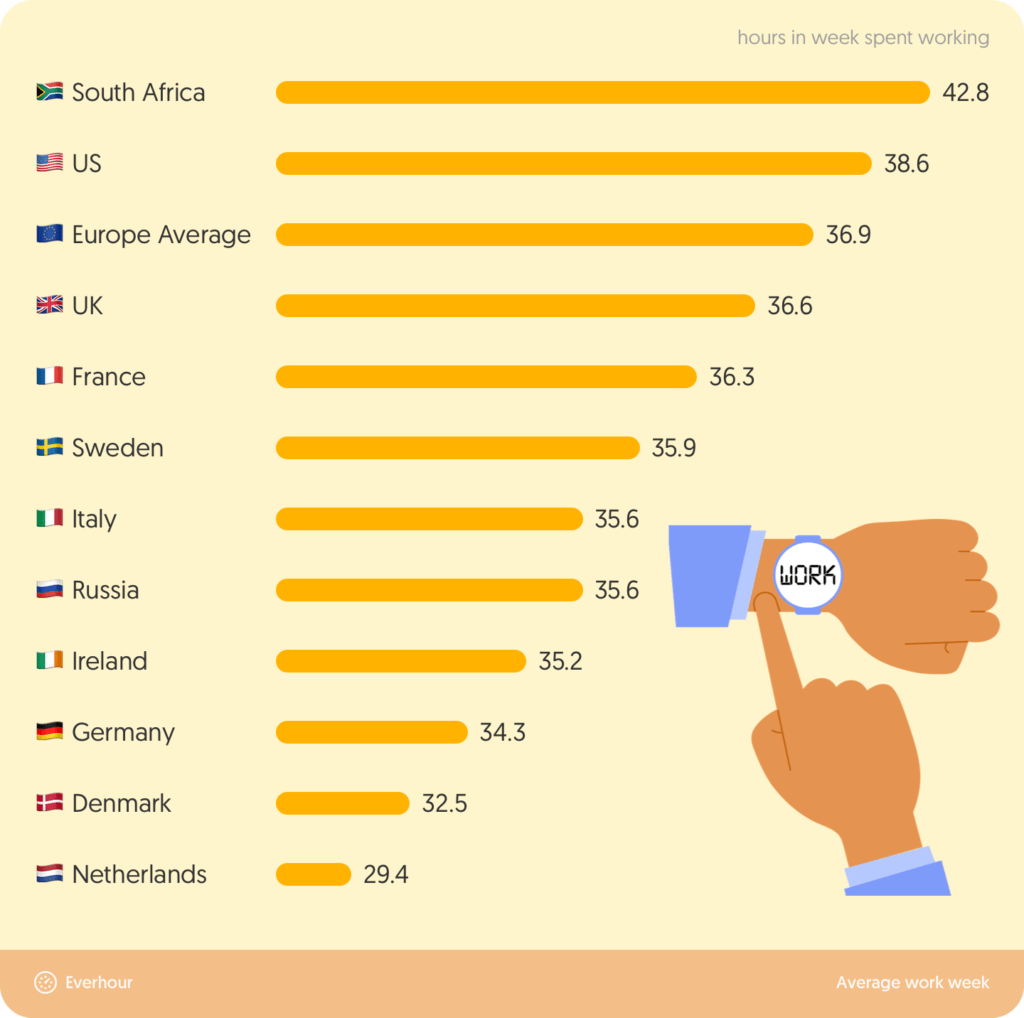

Average Working Hours Worldwide 2022 Statistics

Overtime Calculation In Malaysia Cannonctzx

Overpayment Of Super On Overtime Earnings

Overtime Calculation In Malaysia Cannonctzx

Overtime Calculation In Malaysia Cannonctzx

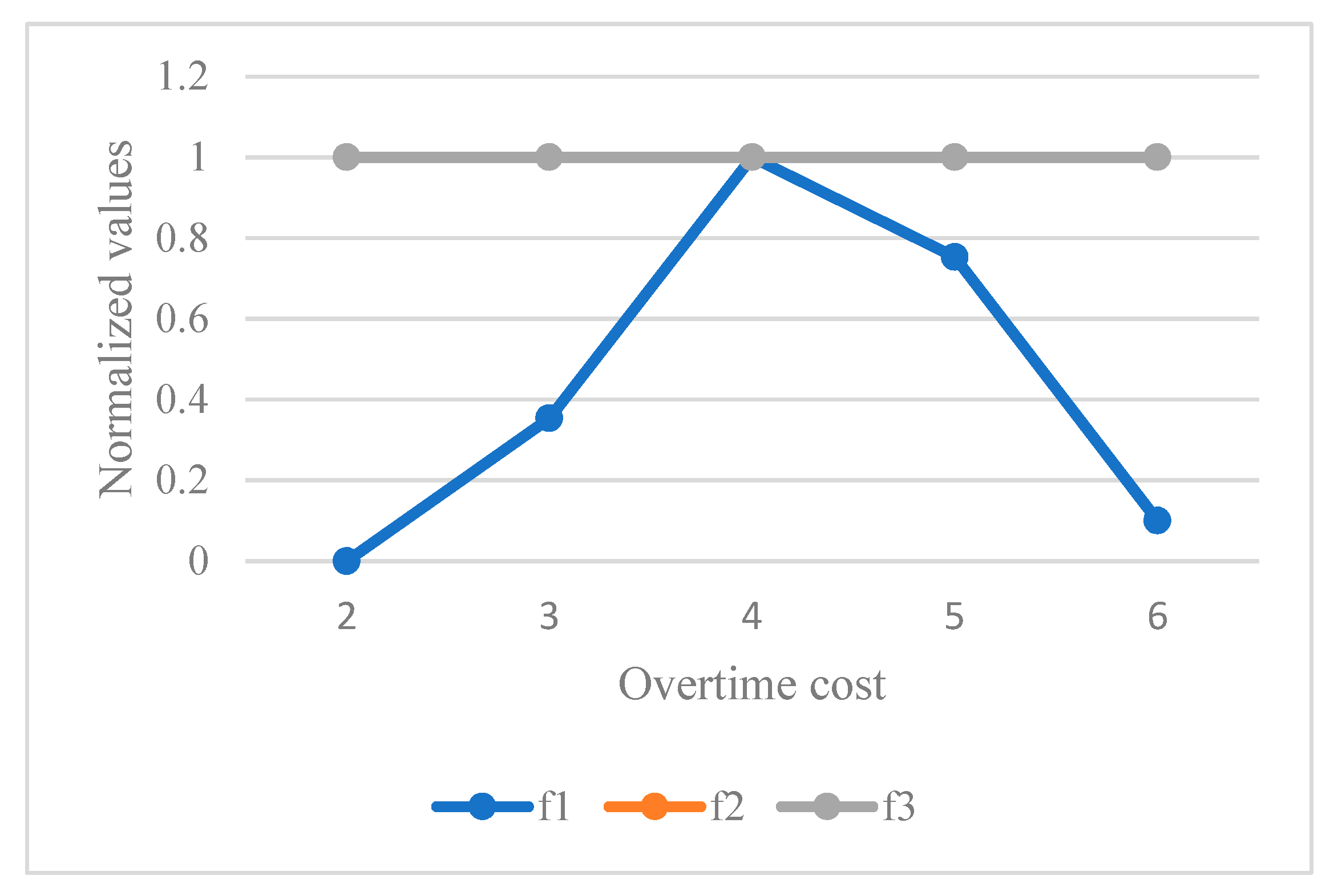

Sustainability Free Full Text Multi Objective Optimization Of Home Healthcare With Working Time Balancing And Care Continuity Html

Pay Schedule And Methods What Are My Options

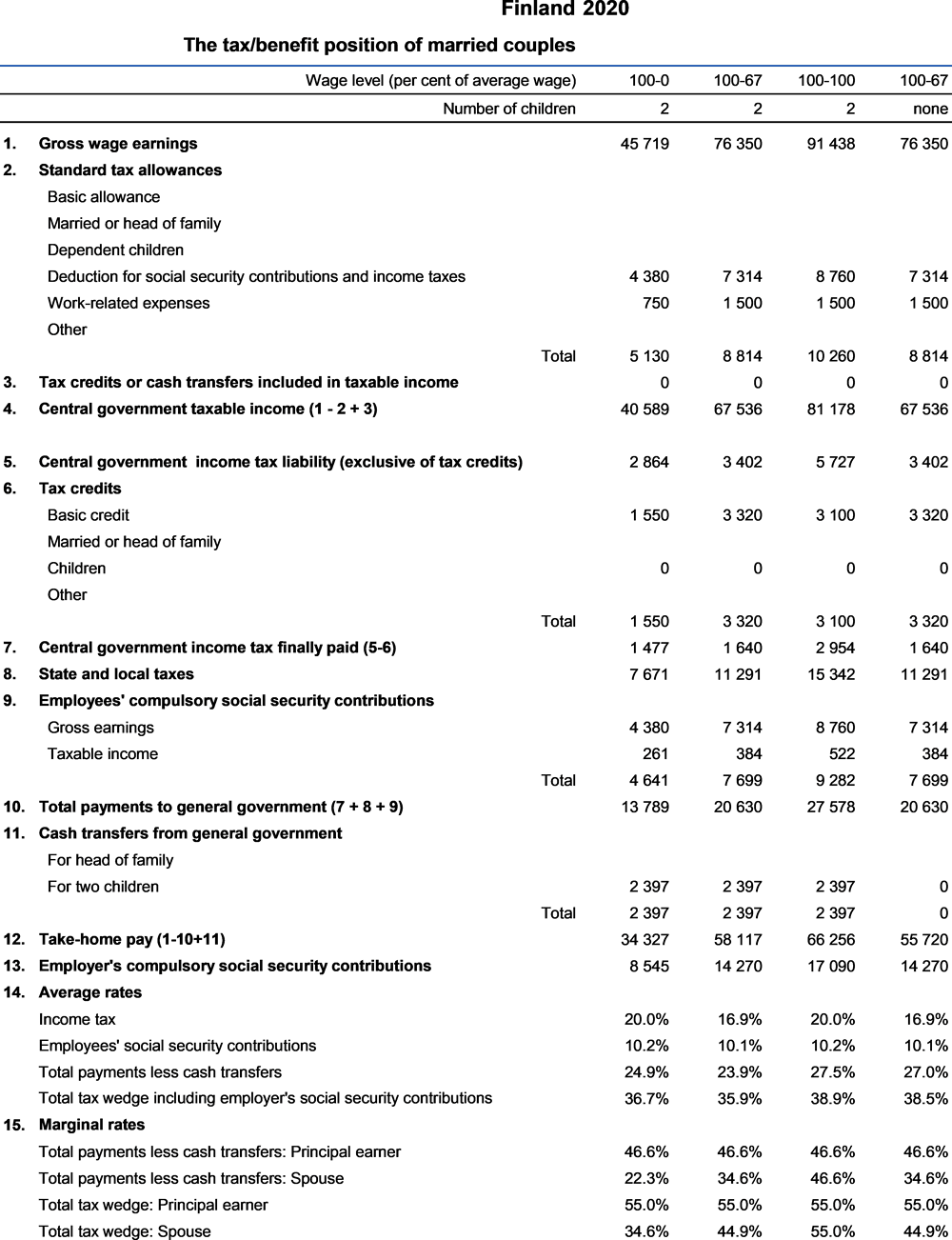

Finland Taxing Wages 2021 Oecd Ilibrary

Sampada Overseas Pvt Ltd Posts Facebook

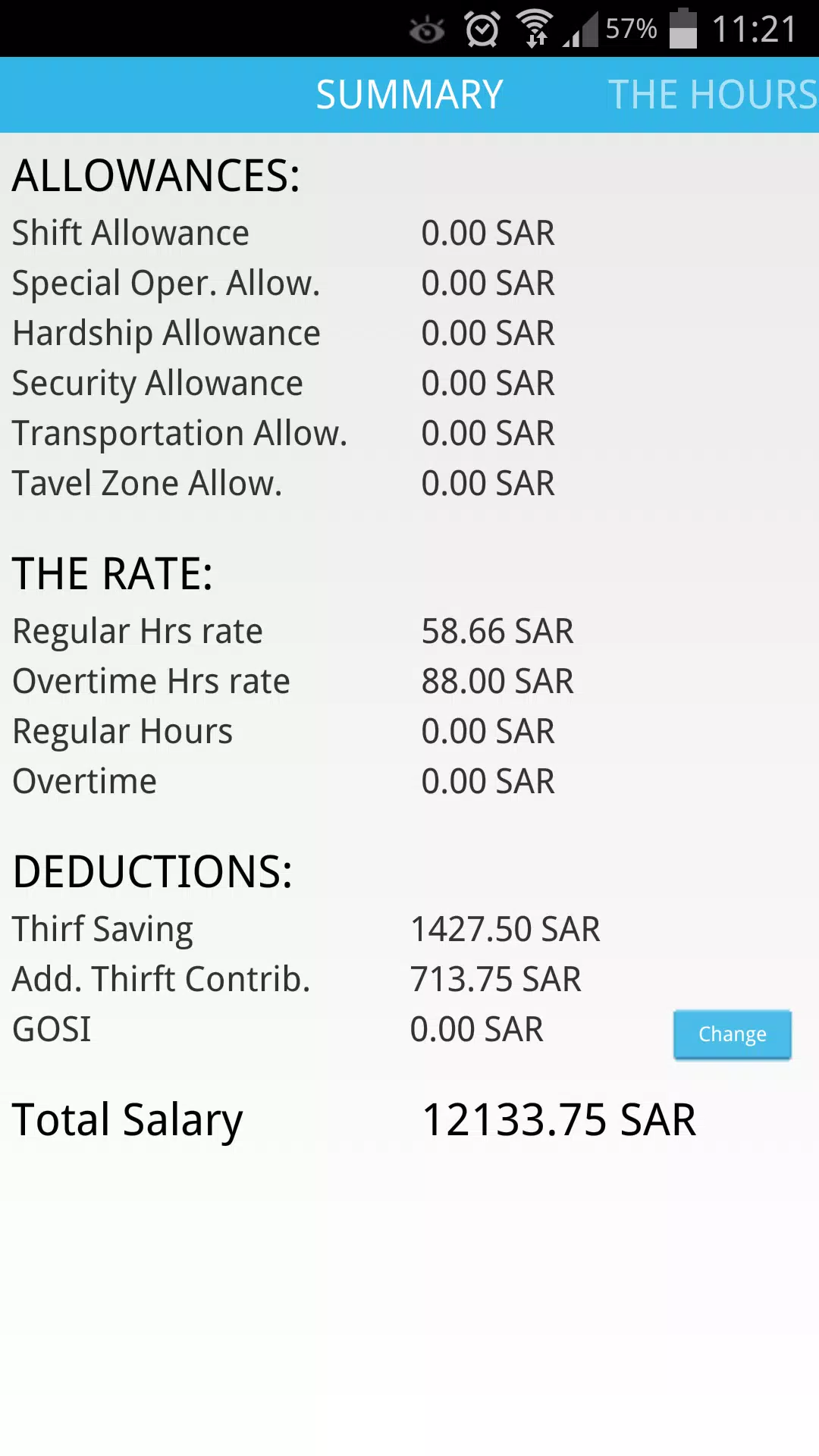

Aramco Salary Benefits For Android Apk Download

Salesman Target Tracking Template Excel For Business Etsy

Rm1 500 Minimum Wage Does Not Include Ot And Allowances